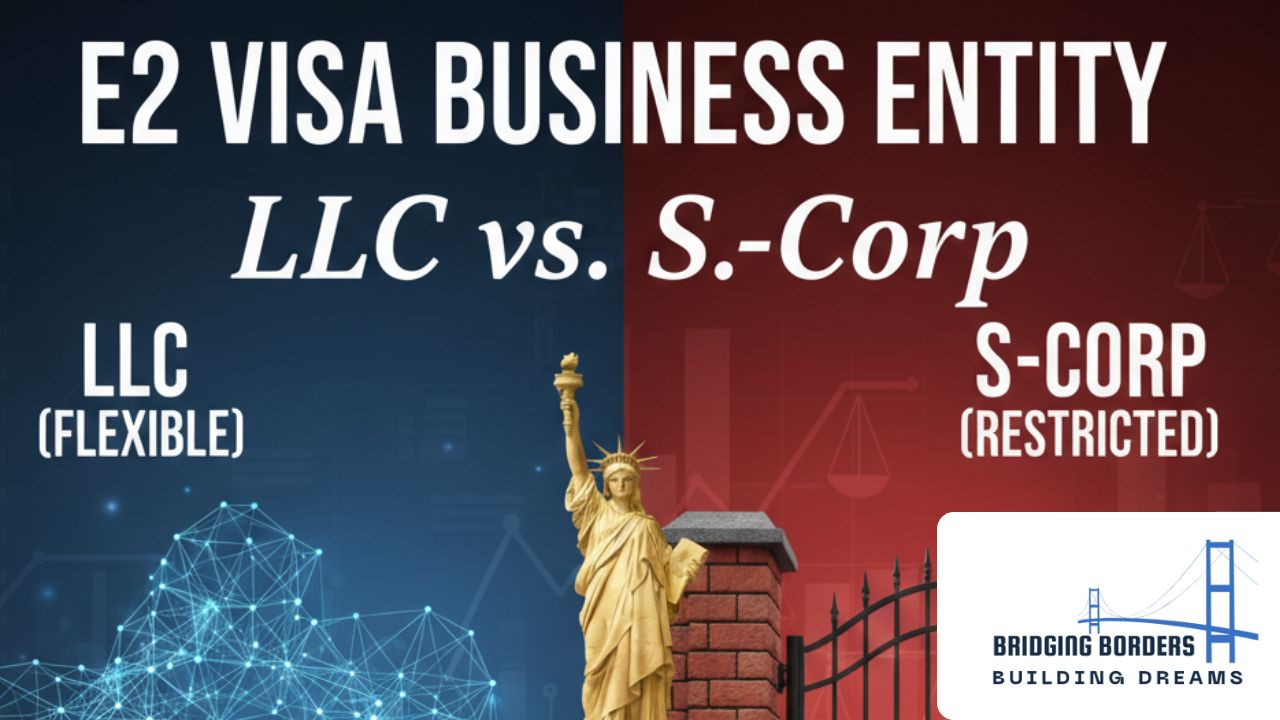

Choosing the Right Business Structure for Your E2 Visa: LLC vs. S-Corp

Choosing the Right Business Structure for Your E2 Visa: LLC vs. S-Corp Date: , Category: For Canadian entrepreneurs looking to expand into the U.S. market, the E2 Treaty Investor Visa remains the gold standard. It offers a path to live and work in the U.S. based on a substantial business investment. However, before you book […]

FBAR & FATCA Reporting for Cross-Border Investors

FBAR & FATCA Reporting for Cross-Border Investors Date: , Category: Cross-border investors often focus on visas, business growth, and tax planning but foreign asset reporting is one of the most commonly overlooked and most heavily penalized areas of U.S. tax compliance. Two U.S. reporting regimes create the most confusion: FBAR and FATCA. While they sound […]

How Are E-2 Visa Holders Taxed in the U.S.

How Are E-2 Visa Holders Taxed in the U.S.? Date: , Category: The E-2 Treaty Investor visa allows foreign entrepreneurs to live in the United States and actively manage a U.S. business. While immigration requirements get most of the attention, U.S. tax compliance for E-2 visa holders is often misunderstood and costly mistakes are common. […]

Top Tax Strategies for E-2 Visa Holders: LLC vs. C-Corp Explained

Top Tax Strategies for E-2 Visa Holders: LLC vs. C-Corp Explained Date: , Category: Choosing the right business structure—LLC or C-Corporation—is a crucial tax decision for E-2 visa entrepreneurs. Your entity affects how you pay taxes, take profits, handle payroll, and support your E2 visa application. This guide highlights practical tax strategies for cross-border investors […]

E2 Visa Requirements for Canadians: Eligibility, Investment, and Documentation

E2 Visa Requirements for Canadians: Eligibility, Investment, and Documentation Date: , Category: The E2 visa is one of the best options for Canadian entrepreneurs who want to invest, start, or buy a business in the United States. It allows Canadians to live in the U.S. and run their business legally, without needing permanent residency right […]